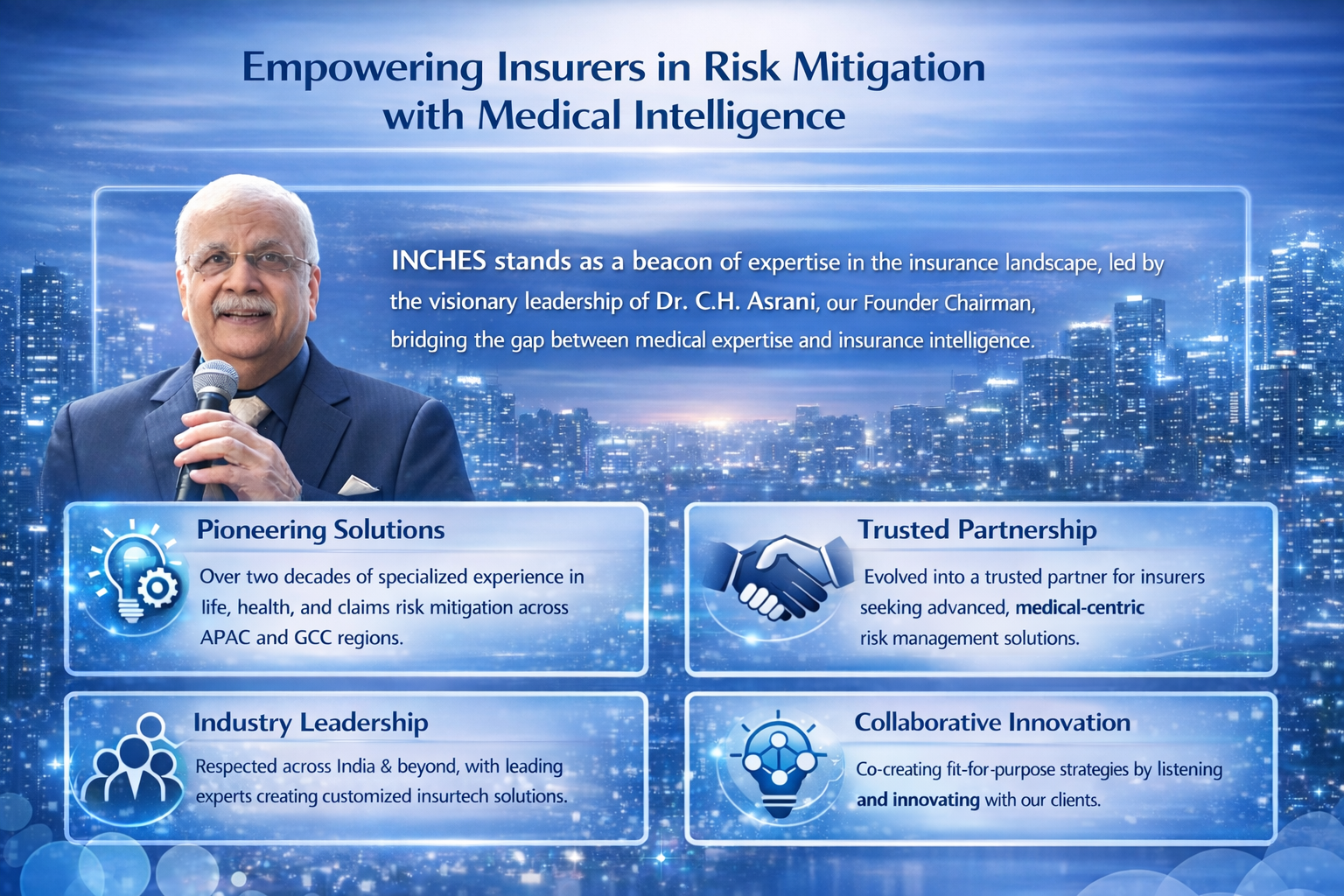

Empowering insurers with intelligent risk mitigation since our inception

INCHES stands as a beacon of expertise in the insurance landscape, founded with an unwavering commitment to transforming how insurers approach risk mitigation. Under the visionary leadership of Dr. C.H. Asrani, our Founder Chairman, we have carved a distinctive niche by bridging the gap between medical expertise and insurance intelligence.

Established on the principle that effective risk mitigation and FWA strategies require deep medical insights,

INCHES has evolved from a pioneering concept into a trusted partner for insurers across India and expanding into the APAC and GCC regions. Our journey began with the recognition that despite thousands of insurtech companies, insurers still sought an ideal technology solution tailored to their unique risk management needs.

With over two decades of specialized experience, INCHES offers comprehensive risk mitigation services spanning life insurance, health insurance, critical illness, accident claims, and motor third-party assessments. Our medical-centric approach ensures that every policy evaluation and claim assessment is grounded in scientific rigor and clinical understanding.

Today, INCHES commands respect and credibility not only throughout India but across the APAC and GCC regions, where many Indian insurance professionals have assumed leadership positions. We collaborate with insurers to co-create customized solutions and services, moving beyond generic insuretech offerings to develop fit-for-purpose processes and tools that address real-world challenges.

At INCHES, we believe in collaborative innovation. Rather than imposing solutions, we listen to our clients’ specific needs and brainstorm together to create storyboards that blend insurer vision with our proven medical expertise. This approach ensures that every solution we develop is not just technologically advanced but practically relevant and immediately actionable.