Catalog of Value Offerings

De Risk

Team INCHES offers critical, intellectual inputs to DeRisk a new concept

Given the huge upfront investments in a new insurance product launch, it is imperative that each product consumes intellectual capital before any significant monetary (financial) capital and effort is invested. New products should be rolled out only after testing assumptions & validating proxies.

At INCHES, we De-risk your novel concepts and ideas before you implement your expansion strategy. We convert your assumptions into knowledge of riders & identify loopholes that help launch your product with lower risk that increases value and provides unprejudiced opinion on how the product will make you succeed or fail quickly – all this with an Indian perspective.

Our bouquet of offerings include:

- Assistance in fine-tuning of Product offerings/ deliverable

- Designing documents pertaining to medical process (UW, Claims)

- Review of policy documents

- Health

- CI & other riders

- Digital sourcing & associated fraud

- Pre-filing policy documents to the regulator. Scrutiny, fine tuning, certification towards medicolegal ethicality and transparency of non-standard terms used

- Review of policy documents to identify future areas of customer grievance / specific concerns to compliance, legal and claims

- Periodic review of products vis a vis projection at launch and loss ratio to suggest modifications/ other actionable

- Underwriting

- Medical matrix

- Creating/ Evaluating the SOP/ Manual

- Claims

- Establishing end-to-end Claims Manual

- Claims process with levels of escalation

- Decision matrix, as well as

- A medical adjudication process

Underwriting

Underwriting has become an integral part of the overall offerings from INCHES. We always envisaged that underwriting would be one of our core product propositions, we were busy sharpening the edges and finally we launched a full-fledged underwriting vertical a few years ago. While the world was obsessed about Data Driven Underwriting Models and Automated Underwriting Systems, we concentrated on building a core team with strong domain knowledge and hands-on underwriting experience. Judicious combination of doctors who are in the Insurance domain for more than two decades & Underwriting experts (SMEs) who have been in the field of Underwriting since long, was the winning formula for our concise product.

Having built our own indigenous Rules engine for Claims, we also know what critical aspect(s) to focus on when catering to the Underwriting portfolio, as using the reverse engineering, we were best poised to deliver what the market required. And we did!

Our unique propositions in Underwriting are:

- We follow a four-eyes approach in underwriting. This means even before recommending for issuance or otherwise decisioning, a second underwriter independently evaluates the case. This is of course for randomly sampled cases.

- Our current team composition in Underwriting is such that almost entirely of the team members are doctors. This means non-medical underwriters have immediate referral points when it comes to critical medical inputs.

- Offering critical inputs for all round Insurance Risk Management has been the specialty of INCHES for over two decades now.

- We also have a CMO team consisting of MBBS+ qualified doctors, who are doing ECG/TMT/Echo/USG/CXR/PFT opinion cases for various insurers. CMOs are also skilled in giving complete medical opinion in accordance with reinsurance manuals and company guidelines. Underwriters have access to these set of CMOs as well. This only means decision making become even more robust and precise.

- Beyond this, there are certain medical conditions & findings where specific rating or guideline is not available. CMOs judgement & assessment becomes very important in these cases. Underwriters can always check with CMOs for these cases. This CMO & Underwriter collaboration saves time, moves business forward.

- Our core operational performance indicators include zero error in them of service quality, maintaining turn around time as for our customer expectation & consistent productivity board and internal standards.

INCHES is offering full-fledged underwriting services with its experienced talent pool consisting of doctors, management professionals and SMEs.

INCHES adapts a multilevel approach to provide support to underwriting function deploying a judicious mix of Tech and human intelligence towards more prudent Underwriting decisions:

- Team is skilled in End-to-End Underwriting & Post Issuance Quality Check

- Strong Team consisting of Doctors, Management Professionals & SMEs

- Our well-trained underwriting personnel ensures that all the requisite documents (proposal forms details, KYC Documents, financial documents, labs & respective investigations done reports) are meticulously screened & analysed as per vis-a-vis set guidelines.

- Term & Non-Term Underwriting

- Health Underwriting

- Financial Surrogates Analysis

- Understanding of Reinsurance Manuals

- Support through VDI or Onsite

Opinion & ECG & TMT Interpretation Led by domain-experts that come with a cumulative experience of over 200 years, there’s no ground uncovered.

i. ECG & TMT Interpretation

- An innovative & smart solution for assessing the ECG & TMT reports, from an insurance perspective & providing a concise & accurate output with the important markers in lieu of UW guidelines.

- With best-in-class processing time frame(within hours), the process ensures that these critical reports are minutely analysed before passing the verdict on them.

- This assists the Insurance companies in improving the TATs for processing the cases, arresting business leakage, along with huge savings, as outsourcing of these services directly results into employing lesser manpower.

- 100% dependable process, tried & tested for its efficacy.

ii. CMO Opinion

- Vintage trained resources, well versed with UW guidelines & Reinsurance Manuals.

- Quickly scalable & customizable process.

- Combination of Medicos & Non-medicos for focussed approach to complete the target in minimum TAT.

- Easy to deploy module, with tech friendly approach.

- We are providing Complete Medical Opinion which fast tracks decision making process.

- Reporting on ECG, TMT, X-Ray, Spirometry, Stress Echo/ Stress Thallium, 2-D Echo, Ultrasound Abdomen, etc.

- Providing complete medical opinion in accordance with company specific guidelines and reinsurer’s manual.

iii- End to End underwriting

Underwriting cases for identification of risk factors helps save companies from adverse selection and identify fraudulent intent.

Objective

- It helps the insurance company to decide the terms on which the insurance will be provided.

- To protect against over insurance, anti-selection, and moral hazard.

- It helps the Insurance company understand the quantum of risk, it has undertaken.

- To protect the company’s book of business from risk that will make loss in future.

- To justify that the insured must have an insurable interest in the subject matter of insurance contract.

Process of Underwriting

- Scrutinizing Proposal form:

Check for Name, Age, Date of Birth, Gender, Location (to rule out Negative

location), Nominee Details (insurable interest), Existing & Simultaneously Applied Insurance details.

Check for Income, Occupation, Avocations, Family history and disclosures made in proposal form.

Checks for Plan details and Premium with SIS or BI. - KYC (Know Your Customer), AML (Anti-money Laundering) and DRC (Dynamic Risk Score) guidelines adherence:

Underwriter establishes the proposer’s identity and financial credentials by assessing various documents like- Pan Card, Aadhar card, Driving License, Passport, Voter ID, Photograph etc.

Adequate financial documents are called as per company’s guidelines (Company’s specific guidelines to be followed). - DRC or Similar guidelines to be checked, High Risk, Medium Risk, Low Risk. Appropriate due diligence is always assured.

Financial Underwriting

- If case is eligible for financial waiver (Credit Score, Occupation & Income Criteria), then financial viability is calculated by considering the lowest of declared Annual income or Credit Bureau income.

- If financial waiver is not applicable:

- For Salaried, Financial viability is calculated after assessing salary slips, Form 16, Form 26 AS, ITR with Computation of Income, Appointment letter with details of employment Bank statement showing salary credits.

- For Self- Employed, Financial viability is calculated after assessing Form 26 AS, ITR with Computation of Income, Profit and loss statement, Balance sheet.

- Other sources can be evaluated if required – Financial Questionnaire, Sales Report, Risk checks carried out through external source, Internet search, Surrogates.

- Earned & Unearned Income is always differentiated.

Medical Underwriting

- Underwriter checks Proposal form for any disclosures.

- As per company’s specific grid, NML (Non- Medical Limit)/ TELE MER / Pre- Policy medical check-up reports are assessed by UW.

- Disease or System specific questionnaire if any (DM Q., HTN Q. Back and neck Q, Gastrointestinal Q) are assessed.

- Final Decision is given as per company’s Underwriting Philosophy and Reinsurer’s Manual.

- Terms at standard rates or accepted with exclusion and loading or decreased Sum assured, or policy is postponed or declined.

Post-issuance QC

At INCHES, we offer post issuance QC, for audit purposes. To understand the area of training required for the underwriters to improve the quality of underwriting.

Underwriting Support—Tech-Enabled Services-Road Map

- Medical Digitization

- Smart data extraction (OCR-ICR-NLP)

- Video MER & Tele MER

- In-house developed Rule Engine, which is incorporated with Unique Rules, which themselves are a combination of underwriting guidelines & Numerous scenarios regarding potential risk to life vis-a-vis disclosures/ Pre- Insurance Medicals

- Precision Check-100% precise, an RPA based decision engine does risk categorization of proposals into –

- Low risk

- Medium risk

- High risk

- Very high Risk

Underwriting@ INCHES has so far been a success story. We are learning with each transaction. As a company, we are heavily investing in this vertical and well poised to move to a position of strength to deliver the highest quality underwriting/risk management services to the industry.

Medicolegal opinions and Clinical Audit

With deep insights into consumer behaviour and physician attitudes, we understand the Consumer mindset especially when perpetrating a medical fraud and have used it extensively in establishing our offering. It helps improve both the efficiency and effectiveness of your claims decisions.

Leveraging medical, forensic and medicolegal insights, INCHES provides Claim Management for life insurance as well as Abuse management through Medicolegal opinions and also with claims at legal fora.

- Claims SOP

- Early Claim Management

- Medico-legal Opinions towards Admissibility of the claim/ Cause effect relationship to Pre-existing diseases(PED) and or non-disclosure / Medicolegal Query letter to hostile provider/ Handwriting & questionable document analysis/ Specialist or Super Specialist opinion, etc.

1. The Process

Each claim case undergoes a defined process where the team:

- Scrutinizes the claim

- Creates a hypothesis

- Plans the investigation matrix

- Analyses the findings

- Makes the final recommendation

Our Services offerings have been structured into:

- Medical Record Review and Interpretation: Medical records (details furnished at policy issuance, claims and procured during field investigations) are reviewed by our Medical team and a summary prepared. Consultation with our physicians/ CMO is also available.

- Case Management: We facilitate and direct the investigation of insurance claim or litigation cases. Investigations, work done by outside investigators is reviewed by INCHES-CLAIM team. Large sum cases are handled from intimation stage to analysis, directing/ monitoring investigation to final recommendation and opinion.

- Opinions to support repudiation and/ or to justify paying of an early claim.

Claim cases are assessed and medically adjudicated largely on the basis of clinical audit taking into account all facts and variables relevant to the claim at hand.

- Opinion on admissibility of claim

- Medicolegal query letter seeking justification

- Show cause notices to treating doctors/ escalation to Medical council(s)

- Deaths / disability due to accidents (including motor 3rd party injuries)

- Unnatural Deaths (drowning/ hanging/ poisoning/ burns)

- An already repudiated case represented at Grievance stage or at one of the legal fora or a case decided against insurer being represented at a higher forum

- Medical indemnity cases/ Declaration of medically unfit

- Medical negligence cases

- Medical Malpractice cases

With in-house expertise in

- All disciplines of medicine

- Generalists, specialists and super specialists

- Forensic medicine expertise

- Doctor cum lawyer on board

- 25 yr+ experience of medicolegal aspect of medicine

- Series of successful representation at MACT, consumer and high court

INCHES is primed to manage complex claims facing an insurer and deliver expert opinions that are medically apt and legally compliant.

Clinical Audit

INCHES is primed to manage complex claims facing an insurer and deliver expert opinions that are medically apt and legally compliant.

- Underwriting

- Claims

We, at INCHES , focus on auditing issues, not people; on developing solutions, not placing blame. Issues are identified and we develop action plans in collaboration with the management. The draft audit report comes along with the action plans and approach for addressing issues.

This approach is vitally useful and allows us to:

- Industry Benchmarks- Share with our clients what we have learnt from handlings claims across insurers

- Help senior management address risk and strengthen internal controls

- Constantly improve our quality because of the insight and wisdom we gain from our partnership with insurers

Types of audits

- Underwriting Audit

- Peer review of documents pertaining to medical process

- STP cases

- Medical underwriting cases

- UW process audit (Post facto)

- Claims Process Audit

- Communication Audit (Repudiation letters)

- Medical audit (Transaction) of claims

- Concurrent

-

- Concurrent claims audit means instant resolution of suspicious claims, as they are done PRIOR to settlement within a short TAT (so as to not cause delay in settlement of admissible claims. This also helps avoid arduous process and time wasted in recovery of amount erroneously paid and in case of internal teams – expensive learning and process refinement.

- Based on trends identified by historic data and prevalent healthcare environment (e.g. monsoons for acute cases and holidays for planned surgeries) the triggers are set in the analytic system to flag outliers, which is then subjected to 2-level medical adjudication and one level medicolegal adjudication (if claim is slated to be repudiated).

- Concurrent audit occurs both at pre-auth stage as well as prior to settlement. INCHES team of experienced and specially trained medicos perform concurrent audit by reviewing clinical information among documents available to ensure rationality of the claim w.r.t. policy terms and conditions as well as medical appropriateness. Needless to say all of the above is managed in rigid timelines as loss containment must go hand in hand with customer satisfaction.

- The final report with conclusion and justification on admissibility are supported with periodic trends of clinical conditions +/- providers +/- consumers, adhering to 95-97% decision congruence.

Additionally, INCHES also aids the insurer with:

- Practices prevalent in the health insurance market today and its impact on the client.

- Inputs w.r.t. claims which have adversely impacted their expectations and reserves.

- Analysis of the increased ICS attributable to COVID / Non-COVID claims

- Helping create benchmarks for future, which can help clients improve Claims cost for both COVID cases and non COVID cases.

-

- Retrospective (based on data available)

- Post Facto Audit is broader in scope with the objective of ensuring that the control framework to mitigate key risks are assessed from an end-to-end perspective to highlight and provide value-added solutions to address issues leading up to leakage and preventable losses through fraud and abuse.

- Herein, settled claims are reviewed to evaluate admissibility.

- This critical mass is sieved through an analytical platform (4Sight) based on several pre-defined clinical and non-clinical outliers, which scores cases with high probability of abuse/fraud. Thus, shortlisted cases are subjected to 2-level manual desk audit by aptly trained and experienced medicos and tagged as Red, Amber & Green.

- The final report with opinion on preciseness of the decision taken by the in-house team/ TPA are supported with trends of clinical conditions +/- providers +/- consumers leading to higher, preventable, ICR. Our recommendations towards curbing losses achieve 95-97% decision congruence.

- Concurrent

- Audit of network medical establishments

- Audit of appropriateness of treatment given (picks out under/ over treatment given)

- Audit for billing abuse (of consumables)

Auto Medical Adjudication(X-claim)

Claim related worries are a thing of the past!

X-Claim is an Evidence based Medical Adjudication application!

INCHES has designed a path breaking, IT integrated system developed on established and accepted Standard Treatment Guidelines with Rule based analytics incorporating the entire care pathway and fraud/ abuse triggers driving an intelligent scoring platform to perform medical adjudication of health insurance claims in real time.

Driven by a team of generalist and specialist medicos with an enviable IT team, X-Claim will benefit the health insurance industry in several ways:

- Address the perennial shortage of well qualified doctors to handle health claims. Well-trained non-medico Data Entry Personnel and an insurer specific slider is enough for X-Claim to deliver upto 70-75% STP results

- Large numbers of claim assessors giving EXACTLY the same results – unheard of in Health Insurance Claim settlement!

- Reduce time taken to process a claim

- Contain leakage and thus fraud and abuse

- Continual update of medical guidelines, drugs database and truant providers

- Covers 18,000+ ICD related clinical rules

- Soon to add PCS codes to 18,000+ ICD codes

Teleservices

THE ULTIMATE FILTER: Tele-underwriting/ Tele-Interviewing

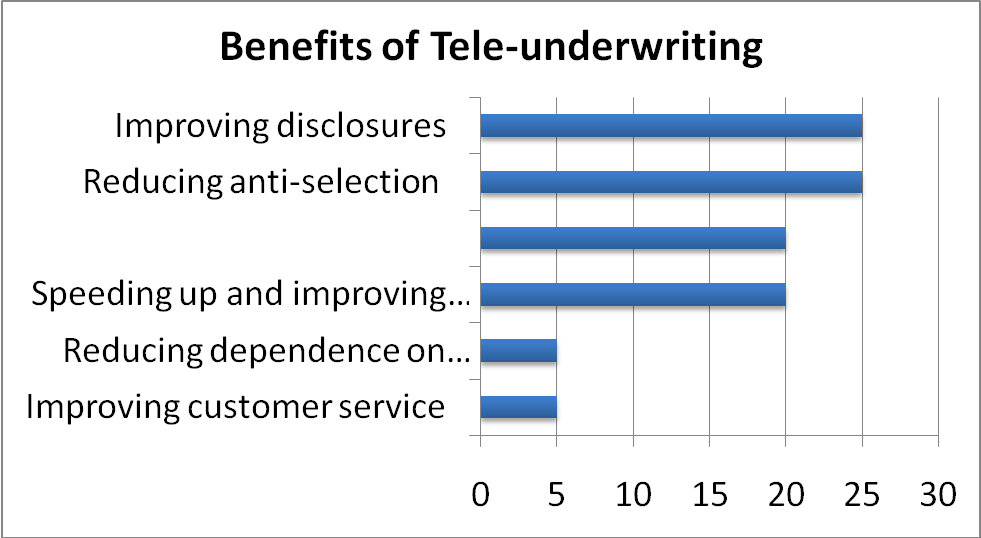

The outlook on underwriting and new business procurement has been challenged since the implementation of Section 45 of Insurance Act 1938. Prudent underwriting has once again regained its value not only in the Life insurance ecosystem but in health and CI products as well. This is further fuelled by increasing demand for Term policies, post Covid.

The entire success of a robust underwriting platform rests on the credibility of the data submitted at proposal +/- medicals done, basis which the decisions are taken. This is a certified nemesis of the underwriters.

The solution – Tele-underwriting/ Tele-Interviewing

Tele-underwriting, a path breaking underwriting innovation, is a streamlined, complete and intelligent fact finding tool. It aims to strengthen and eventually transform the traditional underwriting proposal completion process.

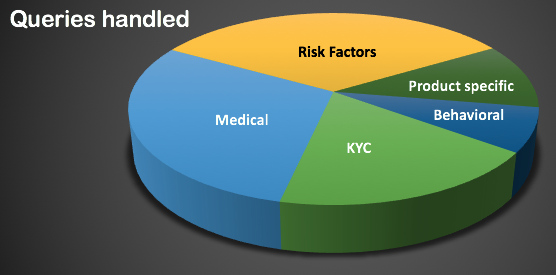

The anchor element of Tele-underwriting is the proprietary interview process based on a structured medico algorithm. Trained professionals who follow a structured protocol, aimed to collect key information to arrive at a sharp assessment, drive this.

70% insurers in the developed western markets like US, UK, Ireland, ANZ and South Africa use Tele-interviewing / Tele UW in some form or the other.

Tele-underwriting is effective in the Life Insurance segment to predict mortality. In the health insurance space & stand-alone CI products, it is perhaps the most efficient tool to predict morbidity. In both cases it can be used as a first filter, even prior to medical tests, to efficiently assess the applicant’s health status and risk factors. This not only expedites the underwriting process but also allows insurers to make more informed decisions on insurability, enabling a quicker and smoother experience for potential policyholders. Tele-underwriting serves as a valuable tool to identify high-risk cases early on, directing resources towards comprehensive medical evaluations for those who need it most, optimizing the overall underwriting workflow in the Life Insurance and health insurance sectors.

At INCHES we offer both Audio and Video tele services; largely tele-interviewing wherein we call the customers on behalf of the client following the algorithm stated to gather best quality data.

The offering of Tele-services @INCHES helps identify false positives and further refine analytic engine

We offer:

- Audio/ Video call at pre-issuance level

- Audio/ Video call at post- issuance level

- Audio call to inform the client about their policy postponement or policy declination and explain the reason from the medical underwriting point of view.

INCHES Academy

INCHES Academy provides the latest in medical and quasi medical education. We empower individual in various fields- be it risk management in insurance, research in health/insurance or clinical practice – with the singular aim of honing their skills and thus reforming quality of care.

Training and Empowerment