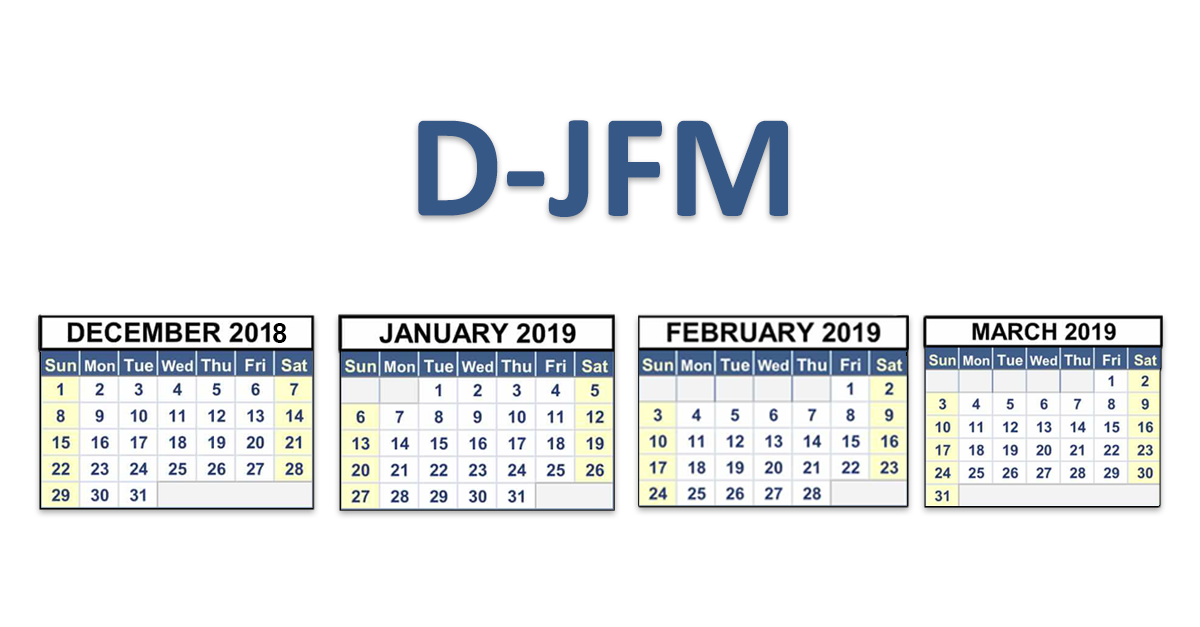

Why is D-JFM so crucial for the insurance industry?

December in geographies following Jan-Dec financial year and JFM quarter in India are crucial for the insurance industry; being the closing of the financial year. Industry operates under twin pressures – pressure of closing at a high new premium amount as well as lowest possible pending cases at claims and legal.

The JFM quarter marks up to 25-40 % of the annual business of any insurance company. The reason of more sales in JFM might be due to part-time agents working rigorously in these months or due to consumers pitched with the view of tax saving or because the insurance companies’ lower premiums to achieve their target or it could be all. Another not so obvious reason is the consumers being aware of the pressures, try to sneak in high risk proposals and experience has shown a large percentage of new policies sold in this period are so-called ‘bad’ lives. Also, probably for the same reason – life insurance gets a large number delayed claim intimation – knowing well enough the pressures to reduce pending numbers and returning attractive numbers to regulator.

Thus, it is obvious both underwriting and claims functions are under much more pressure during this period – both quantum and quality!

The JFM month may be fruitful, but it comes with challenges:

![]()

The way out

It becomes extremely crucial to follow various checks/ processes not only for this period, but for the whole year.

INCHES X-CLAIM is India’s only enterprise to have such an algorithm in place for solutions related to underwriting, medical audit, claims and legal functions, all delivered digitally via a cloud based proprietary tool – by a team of medicos with deep domain experience combining cutting edge technology.

More than 300 years of collective experience in the medical field, along with customized, knowledge-based inputs for the insurance industry combine to create an exclusive enterprise with an unprecedented success rate when it comes to providing solutions for the insurance industry.

INCHES Healthcare Pvt. Ltd understands the pain points of the insurance industry especially during this crucial JFM quarter and has started a special fast track service called X- Claim Fast Track which handles bulk cases, provides the above-mentioned services in a shorter TAT and at a subsidized rate.

INCHES X-CLAIM Fast track will help in:

+91 84549 57562

info@inchesgroup.com

2nd Floor, Metro House,

Behind Mercedes / Honda Showroom, CST Road, Kalina, Santacruz (East), Mumbai 400098