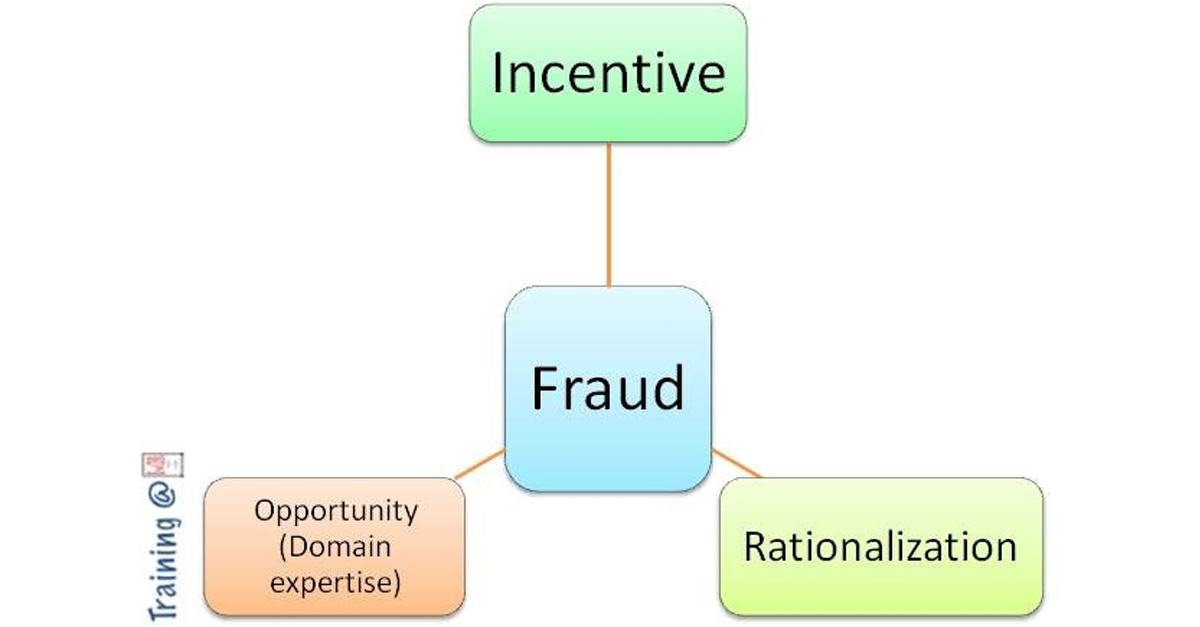

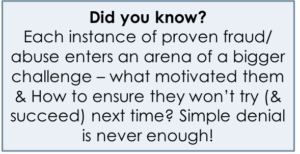

One or more of the following three variables are usually evident in any proven instance of insurance fraud. In large percentage of such claims more than one exists as whatever be the main trigger, rationalization always plays a role.

1. The way out

2. Money – the Numero Uno motivator

3. Motivated by Anger

4. Domain Knowledge/ Opportunistic Fraudster

5. Rationalization

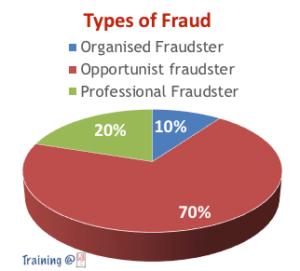

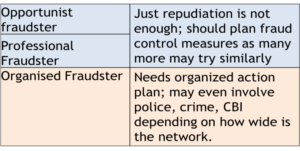

6. Professional fraudsters

7. Organised fraud

Specific Action Plan for each type of Fraudster

Fraudster is more likely to act when they feel/ are certain that likelihood of detection/penalty is minimal. Certain circumstances that provide opportunity to commit fraud include ineffective or absent controls, poor oversight or poor management ability to override controls.

+91 84549 57562

info@inchesgroup.com

2nd Floor, Metro House,

Behind Mercedes / Honda Showroom, CST Road, Kalina, Santacruz (East), Mumbai 400098