X-CLAIM

X-CLAIM is an advanced insurance claims automation platform that leverages real-time analytics, process automation, and multiple integration options to deliver instantaneous, frictionless claims handling across global markets. Its design addresses core requirements for IT-integrated systems based on Standard Treatment Guidelines, with integrated fraud triggers, predictive analytics, and insurer-specific protocols.

Core Functionalities :

- Process Automation: X-CLAIM automates the end-to-end claims lifecycle, from intake and verification to approval and payment. Predefined business rules, aligned with established treatment protocols and insurer requirements, are systematically applied to streamline adjudication and risk assessment.

- Real-Time Payments: The application enables instant, global claim payments in over 90 currencies via diverse payment methods (bank transfer, store credit, digital wallets, cards). Payment is released immediately upon claim approval, radically reducing the typical processing delay seen in traditional systems.

- Integrated Analytics and Decision Support:

- Utilizes statistical and predictive analytic models to flag anomalous claims, forecast risk, and support decision-making.

- Built-in fraud detection using pattern recognition, score-based triage, and automated concern notifications for high-risk claims.

- Insurer Specific Adjustment: The platform’s rules engine and interface allow insurers to set decision “sliders”—for example, targeting a 75–80% straight-through processing (STP) rate—balancing automation with the need for detailed clinical or fraud review.

Feature | X-CLAIM System | Manual Claims Process |

Claim Handling Time | Instant approval and payout | Avg. 18–22 days |

Fraud Detection | Automated pattern recognition, real-time flags | Post-facto investigations, delayed action |

Decision Accuracy | High, with protocol-driven analytics | Variable, prone to human error |

Flexibility | Configurable, multi-country, insurer-specific | Rigid, siloed |

Data Auditing | Full audit trail, regular model re-training | Manual, slow updates |

Protocols, Rules, and Scoring Mechanism

- Protocol-Driven Rules: X-CLAIM’s engine can apply rules based on as many as 28 variables, including diagnosis, treatment pathway, demographic factors, historical claim patterns, and risk triggers. These rules are updated in real-time, incorporating latest protocol changes and insurer-specific preferences.

- Automated Scoring & Concern Highlighting:

- Each claim is assessed and scored according to compliance with treatment guidelines and fraud risk metrics.

- Claims that pass threshold are processed automatically; outliers are flagged for manual review, ensuring that concerns—clinical deviations or suspicious behaviors—are highlighted to investigators and claims handlers.

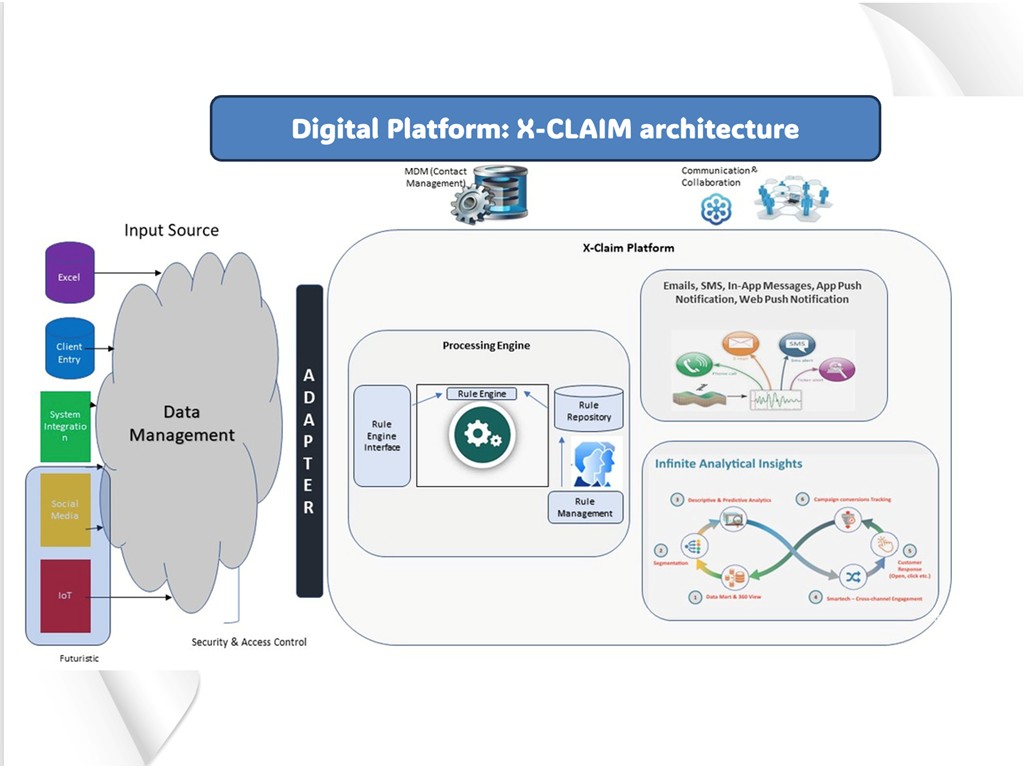

Integration and Modular Architecture

- Global Reach: Supports instant payments and claims processing across more than 60 countries with strong regulatory compliance and multi-currency support.

- Flexible API and Modular Set-Up: Highly configurable for insurers, X-Claim integrates with other insurance tech platforms, external fraud detection tools, and the partners’ own front-end or communication systems (email, SMS, outbound calls).

- Data Security and Regulatory Compliance: The platform is built for full auditability, with regular monitoring and automated re-training of fraud models to remain current with evolving fraud tactics and regulatory changes.

Unique Value in the Indian Context

X-CLAIM’s technology aligns with India’s push for digital health claim exchanges and standardized fraud management under regulatory initiatives like the National Health Claim Exchange (NHCX). Its scalable, rule-driven automation supports the country’s demand for reduced claim settlement cycles, lower processing costs, and greater inclusion for the ‘missing middle’ segment in health insurance.

In summary, X-CLAIM delivers a modern, protocol-driven, analytics-integrated, and real-time claims management solution, well-suited for insurers aiming for automated, secure, and scalable STP-based operations with powerful fraud controls.